How Much Do You Save Buying A House With Cash

Like any other financial decision, though, there are pros and cons to doing so. In short, if you have the money, it may actually be better to buy a house with cash.

LOW RATES GIVE YOU BUYING POWER Current low rates make

Prior to buying a house in cash, you might rent, or borrow to buy something.

How much do you save buying a house with cash. A mortgage can provide tax benefits for some and means a buyer will likely have more cash in the bank. If you do find yourself in a position where a buyer pulls out of the sale, considering a property cash buyer can be highly advantageous and will prevent delaying the process any further. Paying cash for a home means you won't have to pay interest on a loan and any closing costs.

To access it, you’d have to either sell the house or take out a mortgage on it. Buying a house in cash can save you thousands, and you don't have to be rich to pull it off. Cash needed to buy a $400,000 house might start around $27,000, if you qualify for a 3% down payment conventional loan.

Your interest rate is 3.5%. Either way, keep costs low so you save even more money. Skipping out on interest can save you a lot of money in the long run.

If you add a $15,000 emergency fund, the number goes up to $43,774. For example, i bought a mobile home on a lot for $19,500, with a down payment of $5,000. March 12, 2021 share martín elfman for money.

So if you buy a home for $250,000, you might pay more than $60,000 to cover all of the different buying expenses. Buying a house with cash will make you feel like a million bucks. However, if the interested party is a cash buyer and doesn’t require a mortgage, does the.

When shermika bennett entered a bidding war on her dream home last month, she didn’t expect to win out — especially at $25,000 less than other bidders. There are still plenty of those, but when you buy a home with a lender, you have your usual home buying expenses plus all those expenses that go along with having a lender and securing financing. Buyers who pay in cash tend to be looked upon more favorably by real estate agents, and may be more likely than other buyers to secure the home they desire.

Depending on how much you have saved up and how much the house costs, you might find yourself strapped later on if you need funds for repairs, maintenance, or to help fund a life event. In many cases, paying for a house with cash also helps to relieve you of mortgage payments, which home. Money needed for a $400,000 house.

Does it change the legal process? This amount includes some cash reserves, but not a significant emergency fund. In the standard process for buying a home, there are multiple parties involved:

The buyer, seller, estate agent, conveyancing solicitor, mortgage lender and many more if there is a chain. $5,000 (approx.) total cash cost. Buying a house in cash can streamline the process, but it’s not always the most beneficial decision for a buyer.

Not many people can afford to buy a house with cash. Buying a house with cash: Cash purchases save money and time.

With the median sales price of homes coming in above $320,000, that’s not much of a surprise. You may have saved up your money for a long time, you may have come into a large sum of money through an inheritance or prize winnings, or you may have built up enough equity with another home to be in a position such that buying another house outright is possible. When all of this is added together, the average amount of money you need to save to buy a house falls somewhere around $28,774.

When you buy a home with cash, you lock up all that money in the home and can’t easily access it. If you’re getting a mortgage, a smart way to buy a house is to save up at least 25% of its sale price in cash to cover a down payment, closing costs and moving fees. Paying in cash means you get to skip the mortgage process and all the costs and fees that come with it, including interest rates or mortgage insurance.

Cash home buying is rare for a reason. For example, if the purchase price is $200,000, and you’re required to make a 10% down payment, you’ll have to pay $20,000. That’s a far cry from the $160,000 you’d save in interest, closing costs, and pmi by paying for the home in cash.

Some people may want to forgo the mortgage route and pay for a home entirely with cash. It is usually expressed as a percentage of the purchase price of the property. If you are struggling to find a cash buyer, we can give you money for your house and complete within 7 to 28 days.

There are a few ways you might find yourself in a position where buying a house with cash is an option. Maybe you came into a large inheritance, or you’re just really good at saving.either way, paying the price of the home in full. How much cash do i really need to buy a home?

Indisputably, cash purchases carry lower costs.

Winter Tips for Homeowners From saving money on your

Renting vs Buying A Regional Guide [Infographic] Rent

Check out this epic list of smart ways to make money

Should You A Real Estate Agent? Money Renegade

There are many types of budgets. Fixed and variable

16 Things I Quit Buying To Save Money *And You Should Too

I love this 31 Day Saving Money Challenge!!! Save (almost

Make extra money from home doing the things that you do

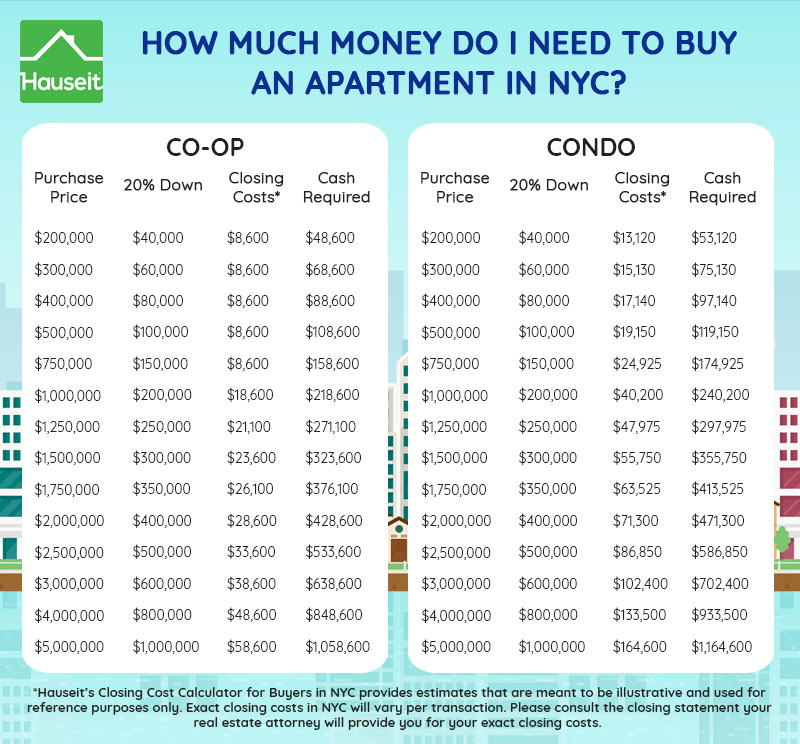

How Much Money Do I Need to Buy an Apartment in NYC? You

Discover how much house you can afford according to Dave

How to Clear Your Shred Pile in a Flash...without a Paper

Do you want to sell your house fast? I'm proud to inform

Learn how much money you can save in a year of brewing

Mortgage overpayment calculator How Much Could You Save

How much does it cost to go to Hawaii? Moneysaving tips

Rent vs Buy Figure Out What Option Is Best For You Rent

Mortgage PreApproval What You Need to Do Preapproved

15 things you shouldn't waste your money on. Money

How Much Do I Need To Retire? Saving for retirement

No comments for "How Much Do You Save Buying A House With Cash"

Post a Comment